|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Cash Out Refinance on FHA Loan: A Comprehensive Beginner’s GuideFor homeowners with an FHA loan, understanding the concept of cash out refinance can open doors to financial flexibility and opportunities. This guide breaks down the essentials of cash out refinancing for FHA loans, highlighting its benefits, considerations, and steps involved. What is Cash Out Refinance?Cash out refinance is a financial strategy where a homeowner refinances their existing mortgage for a higher amount than what is currently owed, taking the difference in cash. This can be a valuable tool for those looking to leverage their home equity for significant expenses. Benefits of Cash Out Refinance on FHA Loan

Considerations Before RefinancingIt's essential to weigh the potential benefits against the costs involved. Consider factors such as current interest rates, your credit score, and the terms of your existing mortgage. Evaluating refinance rates based on credit score can provide insights into the best possible terms for your situation. Steps to Refinance an FHA Loan

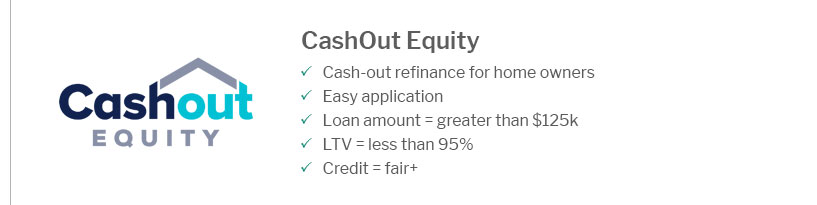

Alternatives to Cash Out RefinanceBefore deciding, consider exploring other options like home equity loans or lines of credit. Each has its pros and cons, and understanding these can help you make an informed decision about whether to refinance home to buy rental property or pursue other financial goals. FAQWhat are the eligibility requirements for FHA cash out refinance?To qualify, you typically need a credit score of at least 580, a debt-to-income ratio under 43%, and a minimum of 20% equity in your home. How much cash can I get from an FHA cash out refinance?The amount depends on your home's current market value, the amount you owe on your mortgage, and FHA guidelines, allowing you to refinance up to 80% of your home’s value. Are there any downsides to cash out refinancing?Potential downsides include closing costs, extending your loan term, and the risk of foreclosure if you are unable to meet the new payment terms. Understanding the intricacies of cash out refinance on FHA loans can empower you to make decisions that align with your financial goals. Whether you aim to manage debt, invest in property, or enhance your home, this option offers a pathway worth considering. https://www.rocketmortgage.com/learn/fha-cash-out-refinance

A cash-out refinance is a way for homeowners to both refinance their mortgage loan and pocket a lump sum payment of cash at the end of the process. https://www.hud.gov/sites/documents/FY16_SFHB_Mod6_program.pdf

Simple Refinance refers to a no cash-out refinance of an existing FHA-. https://www.youtube.com/watch?v=5QRGlTGgP8g&pp=ygUMI2ZycmVmaWFybWF4

Dive into the world of cash-out refinancing with FHA mortgages in this video! Explore the ups and downs of unlocking your home's potential ...

|

|---|